Antifraud system

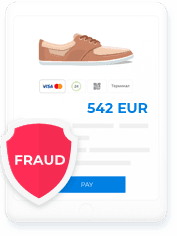

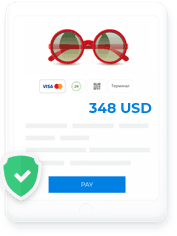

WayForPay Antifraud uses its own scoring model, which helps to identify, analyze a transaction and accurately determine fraudulent transactions.

Connect

WayForPay Antifraud uses its own scoring model, which helps to identify, analyze a transaction and accurately determine fraudulent transactions.

Connect

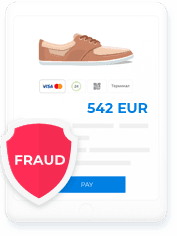

Reducing to zero the number of returned payments made by scammers using someone else’s cards on your site, avoiding penalties and low probability of approved risky transactions. With WayForPay AntiFraud, the level of fraudulent transactions is minimal.

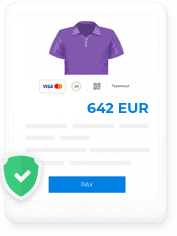

WayForPay AntiFraud has box solutions adapted to various business specifics (air ticket sales, travel businesses, goods sale, online crediting, p2p, etc.). The system has an option of custom configuration for each individual business, taking into account all its subtleties and specifics

Each payment passes through the AntiFraud system, which combines transaction analysis using more than 100 intelligent filters and analysis of the buyer’s behavioral model. That allows you to accurately determine the level of fraud of risky transactions, and to approve the non-fraudulent transactions for payment

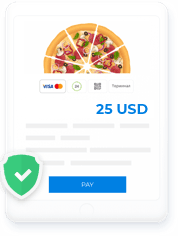

No need to keep a staff to track fraudulent transactions. With WayForPay AntiFraud, your business will get the automated payment processing, based on customer reputation, and detailed verification of every suspicious transaction.

Providing a high level of security against fraudulent payment card transactions on your site. Ensuring maximum security for your customers and business reputation, which can be damaged by the fraudulent transactions when purchasing your products or services

Storing and updating data on fraudulent transactions, for efficient and quick determination of the riskiness of a transaction. Using data on suspicious and fraudulent transactions allows for more quick and accurate determination of the degree of risk of each payment processed by the system

At the first stage of the antifraud process, the seller is being analyzed: the type of his activity, type of product, geographical segment, etc. are analyzed. Individual customization of Antifraud system for specific business allows you to minimize risk level and reduce the number of suspicious operations

At the second stage, the client’s analysis and analysis of client-related information are being performed.

WayForPay Antifraud performs analysis on the basis of more than 100 parameters reagrding each individual transaction, the reputation is then being compiled and tracked, which is then used to evaluate the user. All data is being stored in a database with all parameters that are associated with each user transaction, as well as with the real time payments

Many years' experience of the risk analyst team, the smart system and simple API allow them to work with clients who need exactly the Antifraud system.